It's hilarious to admit this now but I moved to NYC at 18 thinking I’d never have debt or any financial problems. Yep. I was going to transition into the world of financial independence and it would be easy-peazy.

Y'all, I was closing my eyes and crossing my fingers thinking eventually I would make enough money and everything would work out great. What was I on?

...you cannot stumble into healthy savings and spending habits.

I had blinded myself to the complexity that is credit, navigating student loans, renting property, fluctuating costs of living, investing, and the range of topics that contribute to financial literacy for a young adult.

Whether you're dreaming up a new venture or thinking seriously about life as a financial independent I'm begging you. Please don't venture into the financial world, blind, just like I did.

Building a stable financial foundation requires discipline and proactive thinking. It's not about how smart you are, or how much you have in savings. It is about knowledge and discipline. You can stumble into stable finances, but you cannot stumble into healthy savings and spending habits.

The Secret to Financial Stability

It's hard out here y'all! While money has an ebb and flow, you constantly have goals and obligations. It can be incredibly hard to take care of both at the same time. That's why I am convinced that the only way you can guarantee your financial stability over time is with a budget.

I stan budgeting. I believe the reason budgets don't work for people is that there is no one-size-fits-all budgeting system. There are lots of people who budget, some fewer who try to keep them, and fewer still who find success in their efforts.

For people who have tried and failed many a budgeting trick, I don’t think budgeting is at fault.

How to Budget Well

The secret to budgeting well, is finding a system that works for you and how you approach spending. There is a tool for everyone, whether you just want a simple check-in with your accounts, or you want a total biopsy. Here are a few that I would recommend.

Left to Spend

If you've been or are wary of budgeting try Left for Spending (Android) or Left to Spend (iOS). These are apps that allow you to quickly and simply track how much money you are allowed to spend daily. To use it, calculate how much income you earn every month and subtract your recurring expenses. The remainder is the total amount of money that you can spend freely for the month – divide this by 30. Add this number to the app, and every day it will increase your spending allowance by that much. All you need to do now, is tell it when you spend money.

The secret to budgeting well, is finding a system that works for you and how you approach spending.

But say your situation is a bit more complex or you enjoy a more involved approach. I scoured the internet a few years ago for the perfect budgeting app to replace Mint.com – which wasn't a good fit for me. I decided to try envelope budgeting.

Envelope budgeting is the formal name for an old school system. You assign money from your income towards each category of expenses, such as Rent, Bills, and Entertainment. When you’re going to spend money, it comes out of the envelope that the expense belongs to - I’ve found that this method works for my thought process, but can get pretty messy if I don’t pay in cash. How have I solved that problem?

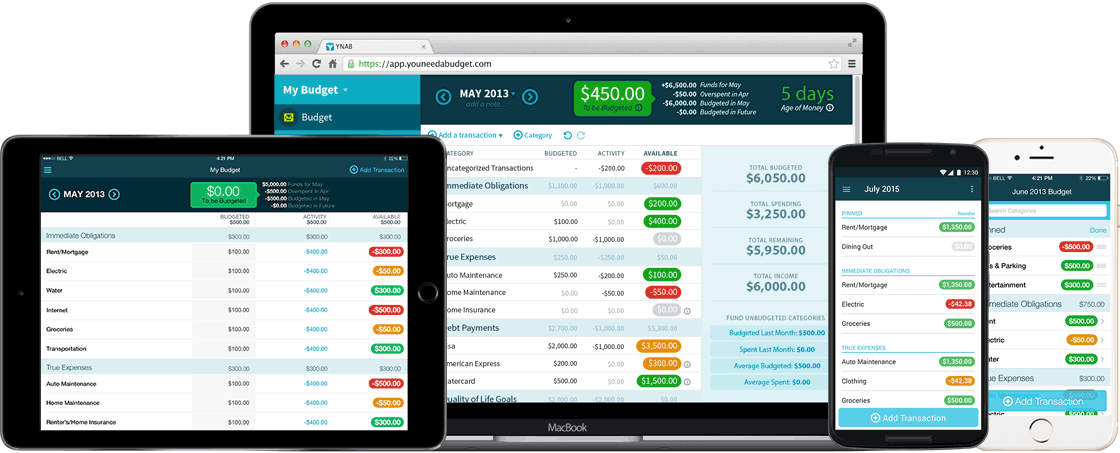

YNAB

Today, I use YNAB. It allows you to track all your accounts, including credit and loans, and give every dollar a job. To help you stay current, it pulls transactions in automatically for sorting. It emphasizes working with the money you have now – so you don't rationalize risky financial decisions. You're encouraged to prioritize the categories you set aside money for.

The big impact YNAB made for me was that there is no roll-over for over-budgeted categories. If you spend it, you account for it. This proved to be the best strategy as I was working to overcome spending beyond my current income.

Honorable Mention - Mvelopes

The first envelope budgeting app I really liked was Mvelopes. Mvelopes also allows you to track all your accounts – including cash purchases. You track your income on a calendar and make a budgeting plan per paycheck. You can save time and energy by scheduling common purchases to assign themselves to the right envelope. Mvelopes helps you get ahead of your purchases by asking you to determine how much of your income you will spend in an envelope, before you earn it.

Budgeting is an important first step in overcoming financial angst and providing for your future stability. It doesn’t have to be a horrendous and grueling practice. The hardest part is finding a method that works for you.

This post uses an affiliate link for the YNAB service.